Update from Michael Burke – Director of Strategy at Beyond Advisors.

Growth forecasts for the Australian economy are seen to be largely on trend at 4.1% (OECD forecast) with increasing risks to the downside. We need to be cognisant of the risks posed by supply chain disruptions, rising prices and how consumers will react to all of these factors.

Major Risks To Growth Forecasts

Supply constraints driven by the ongoing lockdowns in China as their policy response to COVID evolves. Combine this with the impact of war in Ukraine, economic sanctions on Russia and weather events in Queensland and NSW, there is plenty to monitor over the coming months.

Wage and price pressure appears to be growing. With no recent experience around these issues, the outcome could be unpredictable ie price and wage pressures could be faster or slower than expectations. Businesses need to remain alert to these developments.

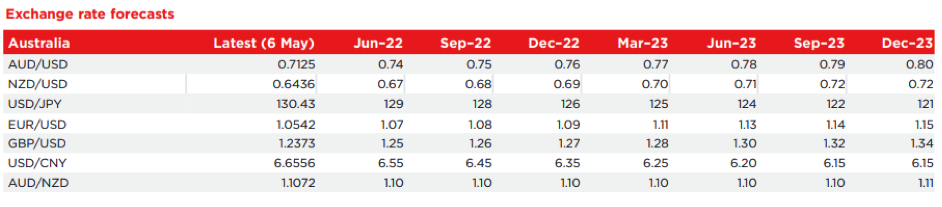

The RBA has pulled the trigger on interest rates with a 0.25% increase in May. Expectations vary across the various forecasters; Westpac expects rates to rise a further 1.40% by November 2022. How this plays out and influences, consumer spending, asset prices, exchange rates and inflation will be an interesting watch.

Consumer Spending Expectations

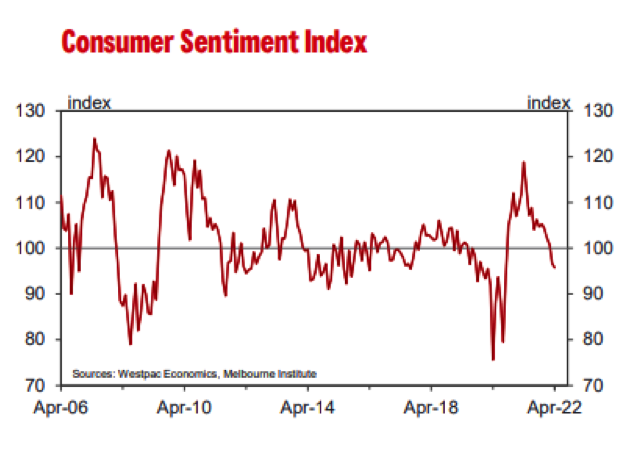

Australians have built up a large cash buffer during the pandemic, their willingness to spend this will have a significant impact on demand forecasts moving forward. The impact of interest rate rise coming earlier and potentially more quickly than expected is yet to flow through to already falling consumer sentiment.

Tips For Businesses in the Current Climate

Quality relevant data is king.

- Monitoring supplier prices and their consistency of supply will be key. Keep open lines of communication with suppliers to get the best feel for what is or isn’t coming.

- Remain nimble on your pricing, keep lines of communication with major customers open so that if you need to increase prices it is not a surprise

- If heavily exposed to movements in exchange rates or asset prices, you will want to keep an eye on the impact of rising interest rates. You may need a change in strategy to protect your business from short term impacts of significant movements, such as; use of hedging strategies, ensuring prices remain flexible and not locked in for long periods.

- Regularly monitoring forward order book trends will be critical in indicating market shifts and enable businesses to respond with adjustments to their cost bases should trends look threatening.

If you are battling with any of the above issues and would like to discuss how you could better protect your business contact me on admin@beyondadvisors.com.au or visit our website.

Michael Burke – Beyond Advisors